2024 Irs 1040 Schedule 1 Instructions – The federal income tax rates for 2024 remain based on the 2017 Tax Cuts and Jobs Act, standing at seven rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates work on a progressive scale, meaning . Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to .

2024 Irs 1040 Schedule 1 Instructions

Source : www.ez2290.com

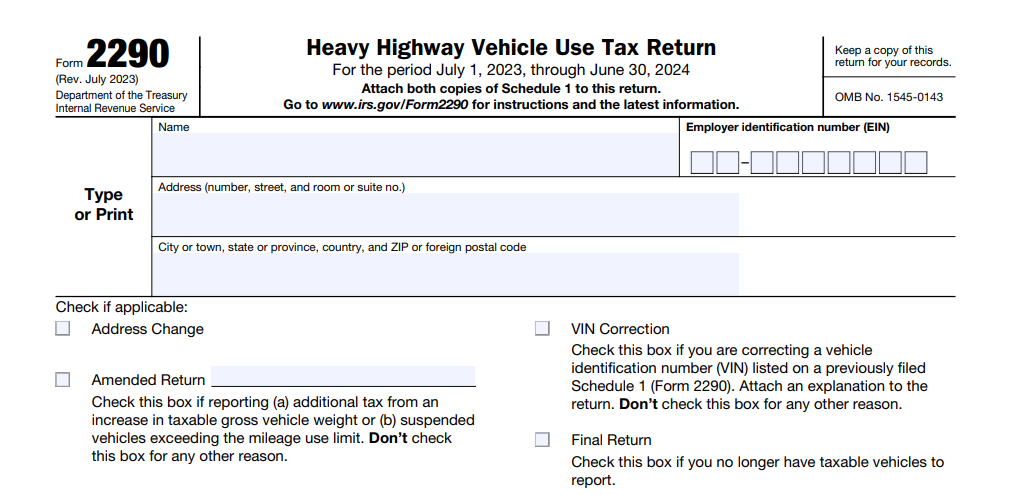

IRS Form 2290 Filing Instructions, Due Date, & Mailing Address

Source : www.trucklogics.com

IRS Form 2290 Instructions for Steps to File for 2023 2024 | J. J.

Source : www.2290online.com

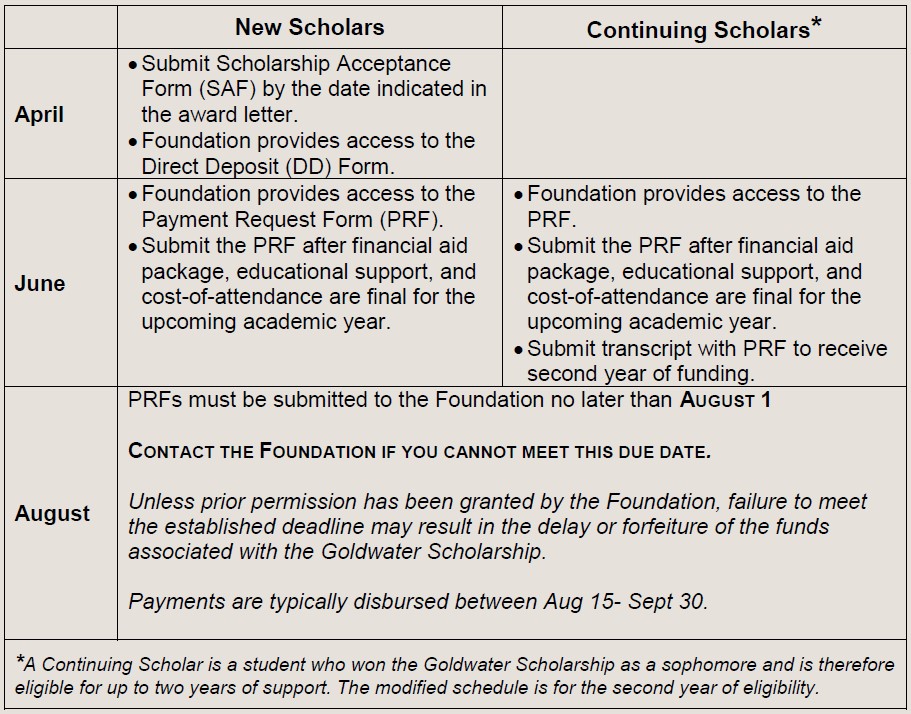

Scholarship Awardees Information | Barry Goldwater

Source : goldwaterscholarship.gov

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

IRS announces new income tax brackets, higher standard deduction

Source : centraloregondaily.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

IRS Form 2290 Filing Instructions, Due Date, & Mailing Address

Source : www.trucklogics.com

Amazon.com: LLC & S Corporation Beginner’s Guide 2 in 1

Source : www.amazon.com

2024 Irs 1040 Schedule 1 Instructions Instructions for IRS Form 2290 | How To File Form 2290 for 2023 2024: The Internal Revenue Service has released its individual income brackets for 2024. Tax brackets are adjusted annually to address “bracket creep,” the name given to describe when inflation . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .